PwC scandal sparks calls to ‘break up the big 4’

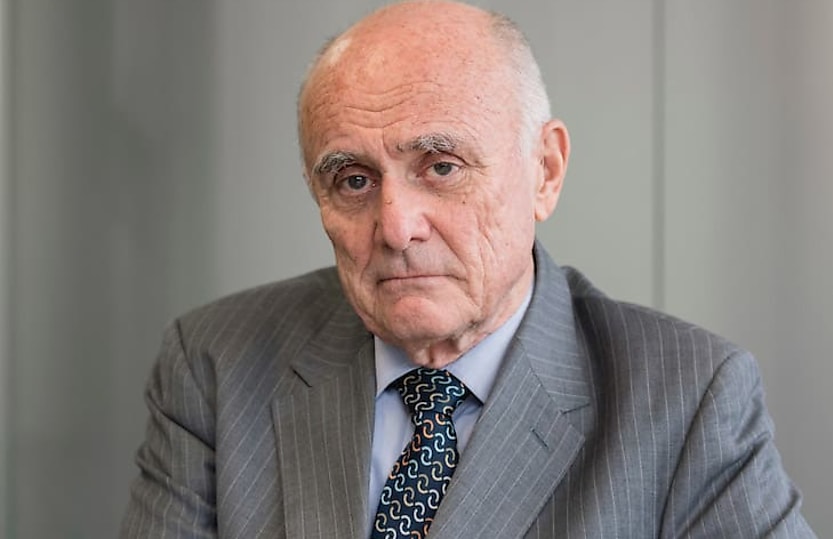

Separating the audit, advisory and consulting services of the big four firms is the only way to ensure the integrity of the audit function, says a former ACCC chair.

Audit businesses should be prohibited from undertaking consulting, advisory and other forms of business with non-audit activities having the potential to compromise the audit, Professor Allan Fels has told the Senate Finance and Public Administration References Committee.

In light of the recent PwC tax leaks scandal, Professor Fels said legislation is required to break up the big four accounting firms and in time, other audit businesses, to prohibit audit businesses doing other forms of business.

The PwC scandal has proven self-regulation and government oversight don’t work and that more drastic action may be required, the professor of law and economics at Melbourne and Monash University said.

“The big four argue that there are benefits from combining consulting and advisory work in a business that does audit,” Mr Fels said in his address to the inquiry into consulting services.

“This is a rather dangerous argument for them to run, because it seems to admit that there is indeed a connection between consulting and advisory activities and audit despite their claims that they can be kept separate.”

The big four firms have also argued that breaking up their firms would be difficult as they’re part of global businesses.

“This is a problem of the industry’s own making and it should and can solve these problems. It’s an area where Australia can lead internationally,” the former ACCC chair stated.

“The PwC scam, in some respects, is a global one but it originated in Australia and the solutions can come from Australia.”

Lessons from the Royal Commission into banking

Professor Fels said similarities could be drawn between the recent PwC tax saga and the situation that arose in banking and finance surrounding the Hayne Royal Commission.

“What the [Royal Commission] found was that on investigation there was a severe conflict of interest of an actual institution and the interest of customers, that was not revolved by self-regulation and government oversight,” said Mr Fels.

“It could really only be solved by a breakup and that’s now happened with banking, they have largely got out of the most conflicting activities. There’s a similar story here, there needs to be a clean breakup.”

While the banks largely voluntarily exited conflicting activities, Mr Fels said there is likely to be strong opposition from the accounting industry to a proposed breakup between audit and consulting services.

“It will require actual legislation,” he stated.

“What I propose about the breakup may appear to be radical but it is far simpler and more effective than alternative methods of dealing with conflicts of interest that inevitably arise when auditing and non-auditing are done by the same firm.”

The industry and regulators have been edging towards the separation of audit and other types of services for a number of years in order to address conflict of interest issues, he noted.

“Despite that surveys of auditors are consistently turning up problems in an uncomfortably large proportion [of cases]. At the same time disciplinary actions are infrequent. Auditing flaws and failures continue to be factor in corporate crashes that hurt stakeholders,” he said.

Mr Fels said there are already inherent conflicts of interest in doing auditing as the audit firm has to report independently on the company that pays it.

“It’s a difficult enough job without overlaying other potential conflicts of interest,” he said.

“The market is also highly concentrated. That means that there’s a rather relaxed climate in which conflict of interest can be accepted as the norm. The finance sector of which auditing is part of is particularly poor at handing conflicts of interest and measures to resolve conflicts in this sector usually work badly.”

About the author