Accountant’s $340k BAS refund claim crumbles

The AAT has backed the ATO’s decision to deny input tax credits over a sham asset sale between two related companies.

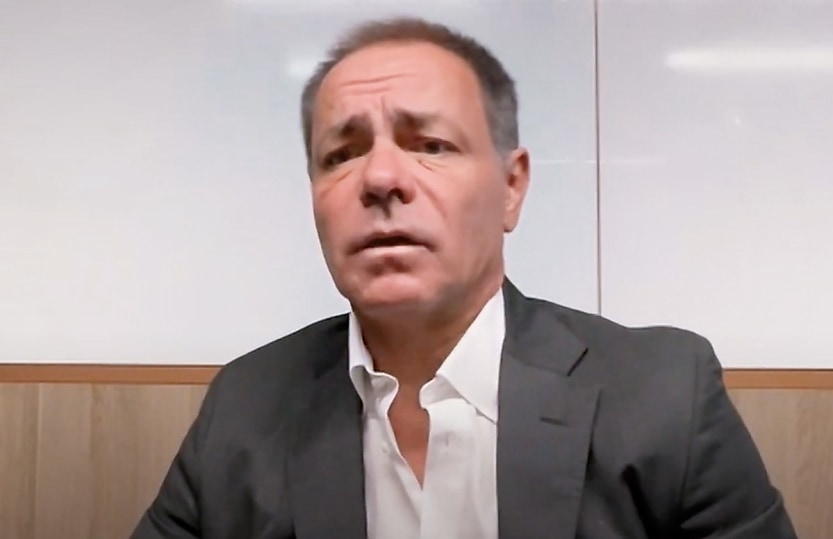

An accountant who was fined $136,000 for claiming a $340,000 GST refund on a sham asset sale between his companies has had his appeal struck down by the AAT.

The tribunal upheld the ATO’s decision to deny Anthony Guy’s input tax credit claim on an asset sale between his companies Ecosse Group Holdings and Siltstone since there was no evidence that a legitimate transaction occurred.

“I am not satisfied there was an acquisition in whole or in part for a creditable purpose so that there could not be a creditable acquisition,” AAT member Rob Reitano said in a judgment last week.

Reitano also upheld the ATO’s $136,000 fine against Ecosse because he found Guy was reckless as to the operation of the law.

He noted how Guy had “particular knowledge” about how GST worked, being a chartered accountant who “had his fingerprints all over the transactions”, and so should have known the ATO would not allow such a blatant tax scheme.

“The notion that the ATO would if the matter had gone further refunded such a large amount of money based on a transaction for which no money at all had changed hands … must reasonably have appeared counter intuitive to a person with the kind of experience and qualifications that Mr Guy held,” he said.

Guy worked as an associate director for PwC in the nineties and holds several university degrees, including a bachelor’s in accounting from James Cook University, a law degree from the University of New England and an MBA from Queensland University of Technology.

He was the sole director and controlling mind of both Ecosse, a private equity firm in the agriculture sector, and Siltstone, which he claimed was an “asset owning company” for Ecosse that did not conduct business activities itself.

Until March 2021, Ecosse accounted for GST on a cash basis, then switched to accruals basis.

In November 2021, Guy created a “sale agreement” where Siltstone purportedly sold various business assets including “goodwill, industrial and intellectual property, permits and licences” to Ecosse for $3.4 million.

Ecosse then claimed a $340,000 input tax credit on its November 2021 BAS.

The ATO denied the refund and imposed a $136,000 shortfall penalty for Ecosse’s false or misleading BAS that “recklessly” claimed an input tax credit when there was no creditable acquisition.

The ATO said, and the AAT agreed, that the purpose of Guy’s scheme was for Ecosse to receive a “substantial” refund from the ATO without any real transaction or tax liability on Siltstone’s side.

Reitano took issue with the agreement for the sale of Siltstone’s assets when many of the assets listed in the agreement either did not exist or were not actually owned by the company.

“There was no evidence, and it was never explained, how Siltstone came to hold or own those assets, if it did in fact hold or own any of them, in the first place,” he said.

For instance, it was unclear how Siltstone, a company owning only assets, could generate goodwill, and the domain name 'ecosse.com.au' purportedly sold to Ecosse was registered in Guy's name instead of Siltstone’s, raising doubts about Siltstone’s ability to transfer it.

The agreement included assets that did not exist due to Guy making it from an unmodified boilerplate template, the tribunal found. It also stipulated that payment was deferred and only due “on demand” by Siltstone, but no actual payment was ever made or demanded for the $3.4 million sale.

With no evidence of any assets to be acquired, and also no demand for consideration, the AAT concluded that Ecosse was not entitled to claim an input tax credit.

“I am not satisfied that under the sale agreement that [Ecosse] acquired anything for the reasons I have stated,” Reitano said.

“No consideration was paid and none was ever liable to be paid under the sale agreement.”

“Ecosse was not entitled to attribute any input tax credit if there was one arising from the sale agreement to the period 1 November 2021 to 30 November 2021.”

About the author