Tax agents hit with ‘petty’ ATO list of old debts as small as 4c

Practitioners predict additional workloads as they seek to reconcile debts recently resurrected by the Tax Office, with one saying the compliance costs outweigh the debts themselves.

The ATO is “scraping the barrel” by reviving “petty” debts worth cents that were previously written off, say frustrated tax agents alarmed at the amount of extra work it has created.

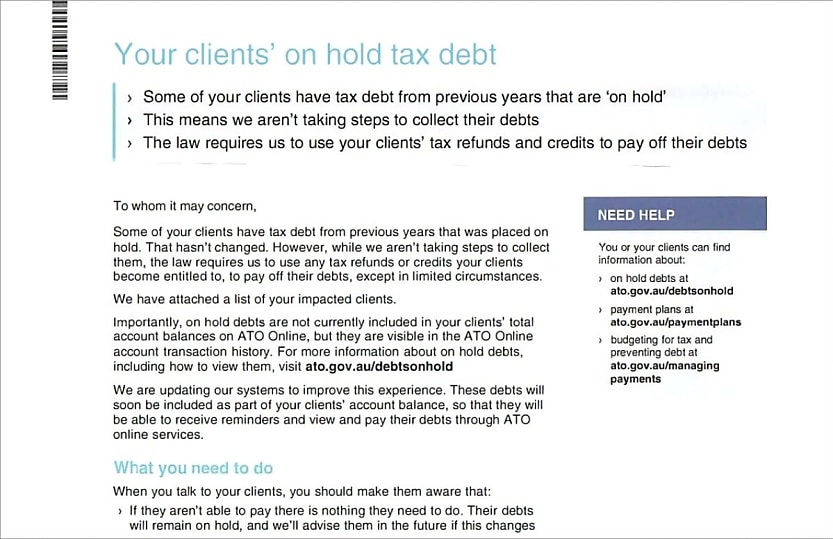

In a letter to thousands of agents last week, the ATO said it would offset clients’ tax refunds or credits against debts on hold that had been written off as “uneconomic” to recover.

“Some of your clients have tax debt from previous years that was placed on hold. That hasn’t changed. However, while we aren’t taking steps to collect them, the law requires us to use any tax refunds or credits your clients become entitled to, to pay off their debts,” it said.

But tax agents said many of the debts dated back decades, were directed to deceased taxpayers or defunct businesses, and were a waste of time to reconcile.

Tax agent Gail Freeman, owner of boutique firm Gail Freeman & Co, said she balked when she received the notice of her clients’ debts, listing what she considered to be “ridiculous” amounts.

“When I got the list, I just burst out laughing,” she said.

“[The ATO] told me I’ve got someone who owes 33c, someone who owes 55c, two people who owe 5c. So out of 20, I’ve got four that are less than a dollar.”

The ATO puts debts on hold when the amount is either “irrevocable or uneconomical to pursue” in line with the Performance and Accountability Act 2013, which requires the Commissioner to manage the ATO to promote the efficient, effective and ethical use of resources.

However, old debts may be reraised and actions to pursue them could recommence if taxpayers’ circumstances changed, and the scope of the ATO’s recovery powers would not be limited by any statute of limitations.

The practice had been paused due to the pandemic and Black Summer bushfires, but as the ATO ramps up debt collections, its sudden and intense resumption has left a sour taste in the mouth of Ms Freeman and other practitioners.

“The costs for us to check all of these is substantially more than the alleged debt,” Ms Freeman said. Despite this, she insisted on doing so “as a matter of principle”.

In its letter to tax agents, the ATO did not include any details about the origins of the debts.

Ms Freeman said it would take “days” of “reverse workflow” to verify the sums, given some were decades old and incurred by people and businesses before they became clients. In one case, she said a debt was listed for a client who was now deceased. Another debt concerned a business client who had not been in business for years.

“We will have to go through them one by one, and waste time on clarifying them. I act for these clients. Many of them I’ve acted for over 20 years. If it’s an ATO error, then I’m going to have to go back to the ATO, whatever it costs my business because my integrity and ethics say I just can’t let it go, even if it’s only 5c,” Ms Freeman said.

“All it’s done is create extra work for us and distress for our clients if and when we tell them.”

“To me, this is defective administration, full stop,” she said. “Scraping the barrel might seem like a good idea to the ATO, but I don’t think it seems such a good idea to the tax practitioners and tax agents working on the other side who end up with all the work to do.”

Tax agent Lisa Greig, owner of Perigree Advisers and CA ANZ program facilitator, also received a letter that affected between 5 to 10 per cent of her client base.

She said that more than half the list she received contained sums of “4c, 5c, 12c” and planned to deal with the amounts on a “case-by-case” basis after the ATO settled her clients’ refunds.

“The letter was a little bit petty, with lots of amounts that are less than 20c,” she said.

“I had a bit of a laugh.”

She said that the lack of a materiality threshold made the list “less meaningful”.

“I would prefer communication with the ATO to be meaningful and I felt having a materiality threshold, which they could have said anything under a dollar they will write off, leaving just a handful of clients that we do need to manage, would have made it more meaningful.”

“The ATO could have also told us when this debt occurred so we can manage it if they do decide to snaffle someone’s refund.”

Accountant John Jefferies, who owns a business providing tax training services to public practices, said there should also be better communication over the possibility for the ATO to resurrect previously written-off debts.

“When someone writes off a debt, they think it’s finished. This is not the case with the Tax Office and I’m not sure that most taxpayers understand that.”

He believed the ATO was acting unreasonably by not filtering out minuscule amounts.

“When we’re talking only a few cents, you know, all that is a waste of everybody’s time, including the Tax Office’s, to try and pursue amounts of that level,” he said.

“Sending letters for this amount, I’ve never heard of before. The Tax Office could have taken that view they’re going to pursue every cent and okay, they’re entitled to that, but I can’t see how that can be efficient tax administration.”