Tax services are ‘urgently needed’ in remote communities

The challenge of connecting tax professionals to underserved communities is complicating Indigenous Australian self-determination, an academic says.

Providing tax services to rural and remote communities across Australia is not a new challenge but researchers from Edith Cowan University (ECU) think they are approaching a downstream solution.

To receive the Centrelink payments that often sustain individuals in these areas, they are obliged to file tax returns to the ATO.

Given many such areas lack a single tax agent and digital and financial literacy tends to be low, relief payments are often failing to get where they are most needed.

“Ironically, the Centrelink and ATO relationship is presenting barriers to Indigenous people moving towards self-determination and fiscal independence,” explained Prafula Pearce, associate professor of law at Edith Cowan University.

“The path to self-determination is being blocked by a lack of taxation services in these remote and regional areas.”

In 2018, the federal government launched the National Tax Clinic Program (NTCP) which, based on a similar US initiative, provides free tax services to underrepresented taxpayers while providing experience for university students.

Since launching, the NTCP has switched from a closed grant process to an open, competitive grant process which will next year see another five clinics added to the 15 already in place.

By 2022, the NTCP clinics assisted 10,000 taxpayers in preparing 12,500 tax returns. It has also delivered 100 educational seminars and engaged with over 100 organisations across the country to claw back millions in tax refunds.

The problem, said Pearce, is the clinics are situated in the cities where their universities tend to exist meaning it is “difficult” to engage regional and remote taxpayers.

Finding a solution has proven difficult. For instance, in 2019, the James Cook University Tax Clinic took its offerings on the road via a series of mobile “pop-up” regional delivery points.

The first, in Ayr, Queensland managed to engage with only a handful of taxpayers because it failed to get the word out to the local population. While some other efforts have been more effective in connecting with clients, they have time and again proven too costly to sustain.

For instance, Pearce shared the example of a trip she and her team at Edith Cowan made to Fitzroy Crossing – a town with no bank branches.

Having chartered a flight from Broome, her team set up shop in the town’s community centre and immediately realised that winning the confidence of the local population was not a given.

“The communities living in that area are very reluctant to [engage] unless they’ve got confidence that they’re going to be looked after,” she said.

Even after engaging a local representative to help temper any concerns, Pearce’s team faced the more significant, albeit expected challenge of delivering tax services to a population with little to no financial education.

“Many didn’t even know their dates of birth, they didn’t know their full names registered with the ATO,” she said. “We found it really, really hard.”

Even though the team managed to get more than $15,000 in tax refunds across the three days of their Fitzroy Crossing operations, its cost was difficult to justify.

What was needed was a more sustainable regional and remote business model. Enter ECU's Carnarvon Tax Clinic.

“While other tax clinics use grant funds to travel to remote areas and provide in-person taxation services, the ECU Tax Clinic took a different approach,” the article said.

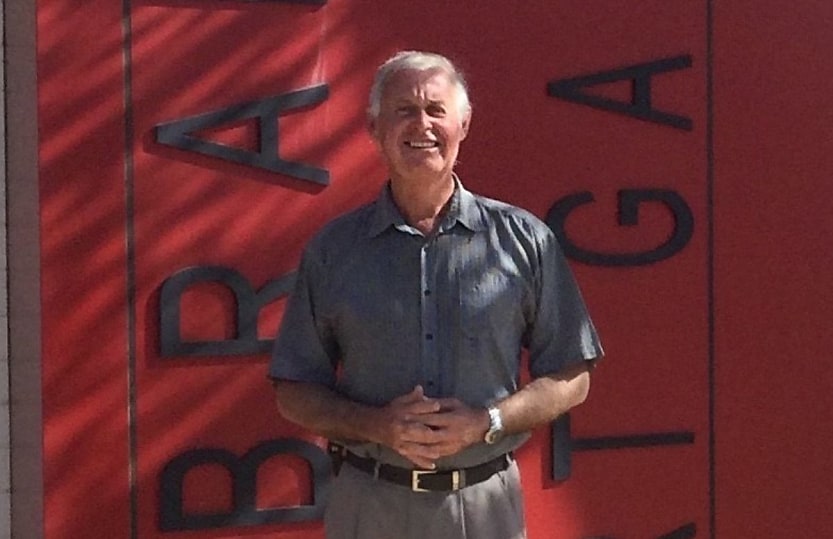

The model is as follows: a local, qualified individual is engaged to work as a client liaison. In the case of the Carnarvon Tax Clinic, this came in the form of Dr Lex Fullarton, a retired accountant and tax practitioner whose family settled in the town in the 1880.

The liaison then facilitates communication over Zoom between students at the ECU Tax Clinic and local Carnarvon taxpayers who make use of a dedicated space in the local library. For two hours every week, Fullarton engages with local community members and bridges any digital or financial literacy gaps.

"We suffer many disadvantages from our physical isolation but communication is not one of them," said Fullarton, adding that "highly developed communications are central to the success of the remote tax clinics such as this ECU project."

“Strong relationships don’t happen overnight. They are built over time and emerge as the parties work together on matters or projects,” read the article, hence the need for a local representative with the requisite financial, digital, and cultural knowledge to facilitate the service delivery.

Since its inception in 2022, the Carnarvon model has been a success, said Pearce. “It’s a fantastic win-win”, seen as a pull factor by ECU’s executive dean as a unique student offering, and in giving underserved taxpayers the help they need to continue receiving their Centrelink benefits.

While Pearce hopes the model will be instructive for other universities, its delivery is contingent on continuing government funding.

“Federal Government funding is the linchpin,” she said, adding “If [they] stop the finding, I don’t think the universities can afford to run them pro bono.”

Neither are the tax clinics the only solution. Reform further up the benefits chain could remove the need for these tax clinics, said Pearce.

“Why can’t there be withholding arrangements instead of paying [Centrelink] all upfront and asking [the recipients] to be financially smart and save some money?”

“It’s not going to happen, it’s not going to be possible for them to learn to save some of their money for tax later on,” she said.

About the author