Are you the ‘average accountant’? Census data gives up its secrets

The Benchmarking Group has mined the latest tranche of census data for the rich seams of information it holds about the tax profession.

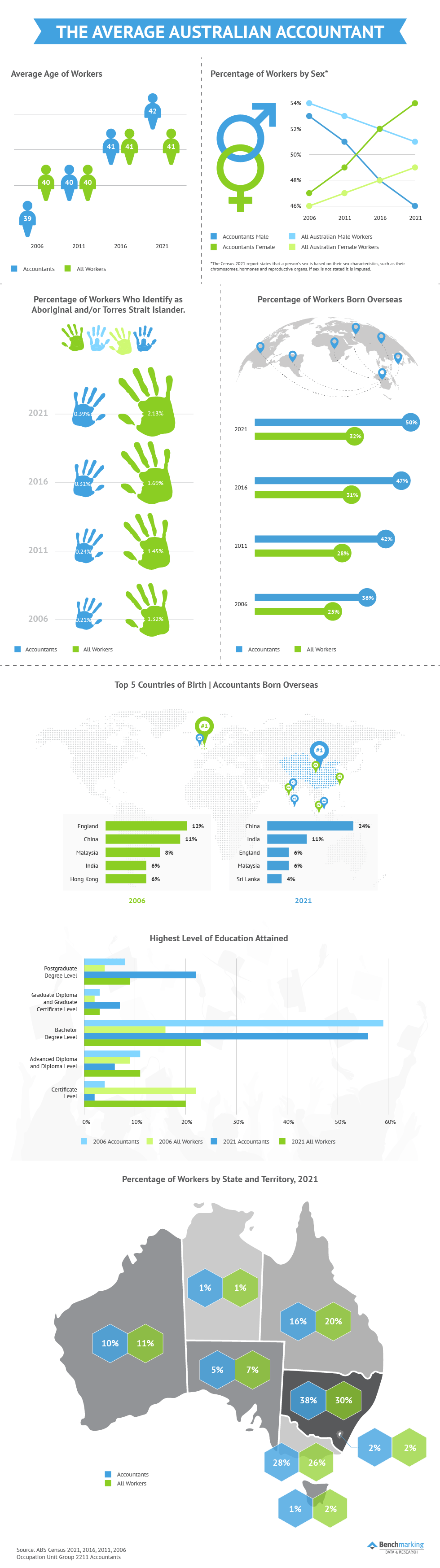

Are you 42 years old, female, born outside of Australia, hold a bachelor’s degree or higher, and happen to live in NSW? Because if you are, then give yourself a pat on the back: you are the very model of a modern tax accountant.

The most recent tranche of 2021 ABS Census statistics contains a wealth of data on employment and industry trends that reveals the shape of the tax profession and how it compares to the rest of the workforce.

The Benchmarking Group has taken a deep dive into that data, and other Census results back to 2006, to piece together a picture of the Average Accountant, and how that has changed over the past 15 years.

The future is female

Over the past 15 years, we have seen a steady increase in the proportion of female accountants. Since 2006, the percentage of female accountants has consistently been higher than the overall percentage of all female workers. However, until 2016, there was always more males in the industry. Then from 2011 to 2016 balance shifted, showing a larger percentage of female accountants for the first time.

In 2021, the proportion of females again increased, suggesting the trend is here to stay. While we have seen an uptick in the overall number of women in the workforce, it is clear the proportion is higher for accountants.

Insights to consider: With an increasing number of female accountants, it would be wise for employers to ensure their workplace caters for flexible working arrangements. Women are more likely to work part-time and, therefore, firms that can offer flexible solutions may be able to better leverage this growing cohort.

Accountants are getting wrinklier

The trend of an aging workforce is occurring slowly, but surely, in Australia. However, the overall average age of all workers has only increased by 1 year since 2006. Comparatively, the average age for accountants has gone from 39 to 42 years.

The increase in age could be due to the decrease in students coming through from university, combined with the overall aging of the population.

Insights to consider: An aging workforce can lead to large waves of workers retiring. The accounting industry should consider how to attract younger people to the profession to ensure the retiring cohort can be replaced.

Small, but rising number of First Nations accountants

Only 0.4 per cent of accountants identify as Aboriginal and/or Torres Strait Islander. This percentage remains well below the comparable percentage for the total workforce. However, it has doubled over the past 15 years. So, while it may be improving, there is more work for the industry to do to attract more First Nations people to the profession.

Insights to consider: The current percentage of Australian workers who identify as a First Nations person is 2.1 per cent. The accounting industry can look to this figure as a benchmark to achieve a greater percentage of Aboriginal and/or Torres Strait Islander accountants.

Accountants are more book smart

When reviewing education trends, we have seen the number of accountants undertaking postgraduate studies increase from 8 per cent (2006) to 22 per cent (2021). This may be partly due to the larger number of internationally born accountants studying master’s degrees in Australia prior to being employed.

Overall, 93 per cent of accountants have declared having a post-school qualification, up from 85 per cent 15 years ago.

Insights to consider: Post-high school qualifications are arguably considered vital for accounting professionals. However, the industry could investigate how to better leverage diplomas and certificates to qualify future accountants as the numbers lag well behind the overall Australian percentages.

More accountants born overseas than in Australia

There are now slightly more accountants who were born in outside of Australia at 50.2 per cent than those born in Australia. While the percentage of workers born overseas has steadily increased since 2006, the number of accountants born overseas has experienced rapid growth.

Foreign-born workers include Australian citizens, residents and any skilled migrant living in Australia in August 2021.

Insights to consider: A high number of foreign-born accountants is not a negative — or a positive. But it is a trend that the industry should be aware of to ensure firms are inclusive of other cultures.

Rise of Asian-born accountants

Over the past 15 years, the number of Australian-based accountants born in Asia has dramatically increased. In 2006, those English-born held the top place for all foreign-born accountants. When looking at all workers born overseas in Australia, England has consistently held the largest percentage. In 2006, 21 per cent of all foreign-born workers in Australia were from England, compared to only 12 per cent in 2021.

For the accounting industry, 24 per cent of all foreign-born workers are now from China, followed by 11 per cent from India. Both these numbers have increased rapidly since 2006.

Insights to consider: With such a large percentage of overseas-born workers, it is clear the industry relies on skilled migrants; a fact demonstrated by the recent accountant shortage during skilled visa restrictions. Firms seeking new employees should ensure they are attractive to the skilled migrant market.

Stating the obvious

Unsurprisingly, NSW has the highest percentage of accountants in Australia. The number of accountants per state largely reflects the overall number of all workers. NSW also has the highest percentage of workers, most likely due to the state boasting the highest number of total registered businesses.

Insights to consider: With many companies offering flexible work options, these figures may change over the next five years, but NSW will most likely remain on top due to the general population statistics.

What do the next five years hold?

While we expect most of these demographic trends to continue, the industry will need to consider how to attract more accounting professionals to meet the growing demand.

We believe the next Census (in 2026) will show:

- An increase in the percentage of female accountants: this may go hand in hand with more flexible workplaces and more part-time workers

- Stability of the aging workforce: we expect the industry will focus on attracting a younger cohort in the immediate future and this should reduce the overall average age

- Increase in location variety: as more workplaces offer remote working, we should see a shift away from NSW as an “accounting hub”

- Continued increase in the number of accountants born overseas: we would expect this number to increase slightly as migrants return to Australia

As a highly skilled workforce and high demand for accounting professionals, accountants should experience an increase in more flexible working conditions and professional opportunities over the next five years.

In short, any accountant can be quietly optimistic about their future.

Please note: the 2021 data was captured in August 2021 and is a snapshot in time. Thus, the data may vary from other ABS reports after/before this date.

Julia Thomson is head of data analytics and content at Benchmarking Group.

Next time: Benchmarking Group dives into the census data on tax profession incomes.